Pro-choice activists hail exclusion of unborn-child provision from tax bill

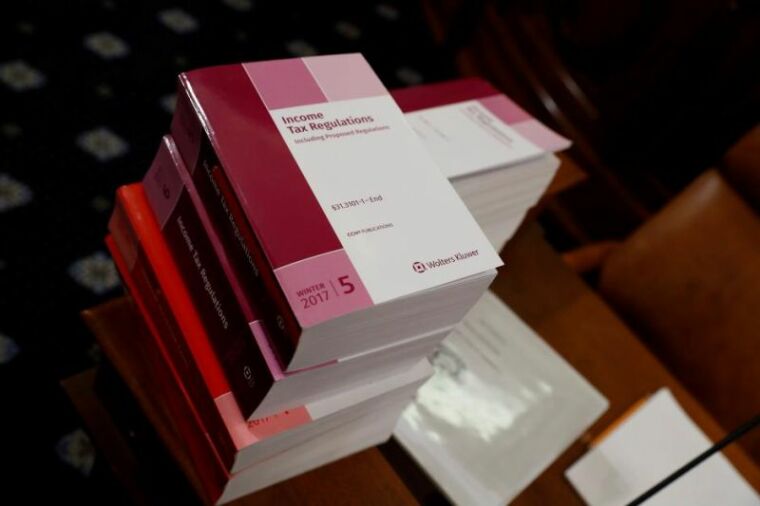

Pro-choice activists have applauded the Senate's decision to remove a provision in the tax reform bill that would have included unborn children in the Child Tax Credit (CTC).

The $1.5 trillion tax relief bill was approved by the Senate by a vote of 51 to 49 on Saturday, but it did not include a pro-life provision that would have allowed tax breaks for pregnant women.

The Republican-controlled Senate rejected the amendment citing the "Byrd rule" which "prohibits changes that aren't directly related to taxes and spending under the process that Senate leaders are using to pass their tax bill," according to Julia Lawless, a spokeswoman for Senate Finance Chairman Orrin Hatch.

According to Life Site News, the amendment, proposed by Montana Senator Steve Daines, would have made the Child Tax Credit applicable to unborn children from the time of their conception.

On Saturday, NARAL Pro-Choice America President Ilyse Hogue issued a statement expressing her approval of the Senate's decision to remove the provision.

"Using the tax bill to assert an ideological definition of when life begins is so out of bounds that we're pleased that the Parliamentarian ruled it out of order," Hogue stated, as reported by The Christian Post.

Hogue said that her organization expects that Republican lawmaker will introduce a similar amendment in the future, and its members "will be ready to fight this again" when that time comes.

Daines' proposed amendment has been hailed by many pro-life groups including the Susan B. Anthony List and Family Research Council (FRC).

"By expanding the Child Tax Credit to cover unborn children, families will receive a double credit in their first year after the baby is born — giving them greater ability to pay for costly hospital bills, diapers, clothes, formula, and lost wages due to time off after delivery," Susan B. Anthony List president Marjorie Dannenfelser said before the crucial vote.

FRC President Tony Perkins stated before the vote that the amendment would be "a huge pro-life and pro-family win" and predicted that it would help individual families as well as the economy by "helping parents better handle the new costs of raising their children."

The approved tax bill is now expected to go through a process of reconciliation with the tax reform package passed by the House. A final version will be produced by a committee composed of members of both the House and the Senate to be approved by both chambers.

While there are significant differences between the two packages, the upper and lower chambers of Congress are expected to resolve the differences quickly so that the legislation could be delivered to President Donald Trump's desk and be signed into law before Christmas.

Christians don't have to affirm transgenderism, but they can’t express that view at work: tribunal

Christians don't have to affirm transgenderism, but they can’t express that view at work: tribunal Archaeology discovery: Medieval Christian prayer beads found on Holy Island

Archaeology discovery: Medieval Christian prayer beads found on Holy Island Presbyterian Church in America votes to leave National Association of Evangelicals

Presbyterian Church in America votes to leave National Association of Evangelicals Over 50 killed in 'vile and satanic' attack at Nigerian church on Pentecost Sunday

Over 50 killed in 'vile and satanic' attack at Nigerian church on Pentecost Sunday Ukrainian Orthodox Church severs ties with Moscow over Patriarch Kirill's support for Putin's war

Ukrainian Orthodox Church severs ties with Moscow over Patriarch Kirill's support for Putin's war Islamic State kills 20 Nigerian Christians as revenge for US airstrike

Islamic State kills 20 Nigerian Christians as revenge for US airstrike Man who served 33 years in prison for murder leads inmates to Christ

Man who served 33 years in prison for murder leads inmates to Christ

Nigerian student beaten to death, body burned over ‘blasphemous’ WhatsApp message

Nigerian student beaten to death, body burned over ‘blasphemous’ WhatsApp message 'A new low': World reacts after Hong Kong arrests 90-year-old Cardinal Joseph Zen

'A new low': World reacts after Hong Kong arrests 90-year-old Cardinal Joseph Zen Iran sentences Christian man to 10 years in prison for hosting house church worship gathering

Iran sentences Christian man to 10 years in prison for hosting house church worship gathering French Guyana: Pastor shot dead, church set on fire after meeting delegation of Evangelicals

French Guyana: Pastor shot dead, church set on fire after meeting delegation of Evangelicals ‘Talking Jesus’ report finds only 6% of UK adults identify as practicing Christians

‘Talking Jesus’ report finds only 6% of UK adults identify as practicing Christians Mission Eurasia ministry center blown up in Ukraine, hundreds of Bibles destroyed: 'God will provide'

Mission Eurasia ministry center blown up in Ukraine, hundreds of Bibles destroyed: 'God will provide' Church holds service for first time after ISIS desecrated it 8 years ago

Church holds service for first time after ISIS desecrated it 8 years ago Burger King apologizes for 'offensive campaign' using Jesus' words at the Last Supper

Burger King apologizes for 'offensive campaign' using Jesus' words at the Last Supper Uganda: Muslims abduct teacher, burn him inside mosque for praying in Christ’s name

Uganda: Muslims abduct teacher, burn him inside mosque for praying in Christ’s name